PayPal does not disclose how much those fees will cost, and it can even vary from state to state.

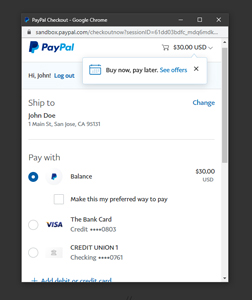

There are no interest rates when you use Pay in 4, though you could be charged a late fee if you miss a payment. What are PayPal Pay in 4's interest rates? It's worth noting that Splitit and Afterpay don't perform a credit check, while Klarna and Affirm do. He added that "Pay in 4" stands out from other buy now, pay later plans because "a lot of consumers want to avoid paying credit card interest and want to borrow money without a credit check." The new feature may selectively perform soft credit checks, but those won't affect your credit score, according to MarketWatch's interview with Doug Bland, vice president of global credit. Will my credit score be affected with Pay in 4? No straightforward breakdown of late fee costs.If you're looking to finance pricier purchases like expensive furniture, you might exceed the $600 limit.Use at hundreds of retailers, including Aldo, Fossil, Best Buy and Bed, Bath & Beyond.Manage your payments through the PayPal app or.Finance items that range from $30 – $1,500.You'll make the next three payments every two weeks. Make your first payment to complete the checkout process.You'll be notified if you are approved instantly.When you reach checkout, select Pay in 4 as your payment method.Using PayPal's buy now, pay later service is pretty straightforward: Note that this service is not currently available for residents of Missouri, Nevada or New Mexico.

How does this payment plan stack up against similar services like Affirm and Afterpay? We took a closer look. Navigate your purchases and money owed directly through your PayPal wallet. You can use this plan on items priced between $30 and $1,500, with biweekly payments. PayPal has entered the fray with a feature called “Pay in 4,” which allows shoppers to finance their purchases in four smaller installments. The buy now, pay later industry is getting a run for its money.

0 kommentar(er)

0 kommentar(er)